Having a pre-certification, loan providers have confidence in care about-said information to provide a bid. It doesn’t usually need them to be sure their borrowing, a job, otherwise financial papers.

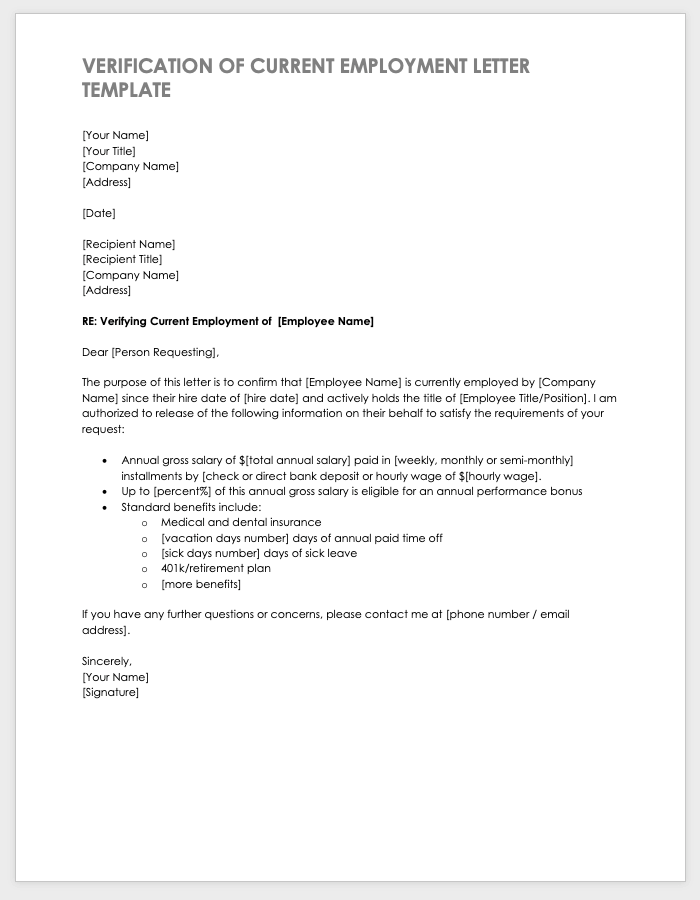

In addition, pre-acceptance involves verifications to approve you to have an interest rate. Loan providers remark your borrowing, make certain your own a career, and check out financial records, for example shell out stubs, bank statements, and you may tax returns.

When you’re ready making an offer on your domestic, an excellent pre-recognition says to the vendor that you will be a prescription client who’ll manage to purchase their house, providing a benefit more low-accepted and you can pre-licensed consumers.

To higher comprehend the difference in pre-degree and you may pre-acceptance, let us take a closer look at whatever they encompass, just what pointers they want, as well as the timeframes associated with per.

- → What’s Mortgage Pre-Degree?

- → What’s Home loan Pre-Approval?

- → What’s the Difference between Pre-Recognition vs Pre-Degree?

- → Exactly what do You ought to get Pre-Acknowledged?

- → How much time Really does Pre-Qualification or Pre-Acceptance Capture?

- → The thing that makes Pre-Acceptance To have a mortgage Very important?

- → Try a great Pre-Approval Page the same as Trying to get a loan?

- → When Is the greatest Time to Get Pre-Acknowledged?

- → Our very own Advice Have fun with good Pre-Recognition whenever you are Intent on To invest in

What’s Financial Pre-Qualification?

For example, they are going to enquire about your earnings and you can even though you may have a downpayment saved up. Loan providers may also inquire about very first details about your credit score and you will monthly debts.

When they opinion this particular article, loan providers will provide a bid instead of verifying the details you offered her or him, or appearing after that into your income, investments, and possessions.

But remember that the pre-qualification imagine is not informative. It’s just a concept of simply how much you can acquire. The real amount usually alter while the lender works borrowing and you will verifies debt data.

You need to use good pre-qualification just like the a guide to determine your budget, although not way more. These could be useful having people who are not seriously interested in to invest in property in the near future.

What’s Mortgage Pre-Recognition?

Mortgage pre-approval is actually a far more sturdy indication of the power to secure a home loan. It is a step past pre-qualification by the looking at your credit, guaranteeing debt data, and you may making you be noticeable among other home buyers when it’s time and energy to make an offer.

Which have pre-acceptance, lenders eliminate a challenging query on your credit history and you will verify per source of income you number to your application for the loan. They might be your pay stubs, W-dos comments, and you may, in many cases, your 1099s and you may taxation statements.

Tip: Difficult borrowing from the bank issues will simply decrease your score because of the five issues or smaller. The rating will return right up after a few weeks as long as you manage regular borrowing from the bank recommendations.

A great pre-recognition allows lenders to determine the debt-to-money proportion, and that says to him or her just how much you could potentially use. As well as that recognition, you’ll get a keen itemized guess of interest prices, closing costs, monthly payments, therefore the limit amount you happen to be approved to purchase.

By giving your good pre-acceptance, the lending company says you may be a totally acknowledged buyer. When you see a home, and it’s really time for you to get your home loan, the lending company only needs to approve the property you happen to be to get ahead of issuing the full home loan approval.

You to definitely big advantage pre-recognition provides more than pre-certification would be the fact it may be the essential difference between delivering an acknowledged provide on the property otherwise losing it to some other consumer.

Sellers in addition to their agencies remember that pre-approvals indicate more pre-certification, and they will barely view an offer that doesn’t tend to be a pre-approval letter.

What is the Difference between Pre-Acceptance against Pre-Certification?

Pre-recognition are an even more inside the-breadth techniques where loan providers guarantee your credit and you may financial recommendations in advance of providing you with an in depth mortgage imagine. Pre-certification depends on mind-advertised suggestions instead taking any additional confirmation tips.

As you can tell, pre-qualification cannot thought one affirmed papers, meaning it does not allow you to get one nearer to delivering home financing.

But not, pre-recognition means far more in order to sellers, because need lenders to verify your financial pointers and you may accept you – the buyer – to own a home loan. Together with, it does pinpoint your residence-to find funds.

The conclusion mission is to get the full home loan recognition, perhaps not the full financial certification. We usually advise beginning with an excellent pre-approval as they are even more real, make you details, and therefore are part of the financial processes.

Pre-approvals suggest www.paydayloanalabama.com/ray/ so much more in order to suppliers and permit you to definitely quick-submit the borrowed funds process once you discover a home you like.