What you need to realize about the brand new well-known financial-borrower matchmaker.

When you find yourself trying to find property, then you’re most likely interested in a mortgage, also. For the reason that techniques, you’ll likely stumble on the name LendingTree.

No matter if it is really not a home loan company alone, LendingTree makes it possible to pick financing to invest in your residence purchase. To your tagline May a knowledgeable mortgage win, its an online marketplace enabling that comparison-buy all sorts of financing. They might be mortgages, auto loans, home improvement fund, and others.

The market industry revealed inside 1998 features offered over 100 million consumers because. Nonetheless, despite their record, LendingTree’s solution isn’t really suitable for men-nor is it constantly by far the most economical choices. Are you playing with LendingTree for your home financing? Definitely feel the entire visualize earliest.

Just how LendingTree Functions

LendingTree aims to improve the borrowed funds-searching process by giving users numerous funds has the benefit of all the towards one single-band of advice. Towards the front-stop, customers diary on to LendingTree’s webpages, enter particular 1st study, following discover up to four prospective loan options via email. ? ?

- Loan method of-first pick, refinance, house security

- Assets type-single-family, condominium, or flat

- Possessions have fun with-primary home otherwise travel property

- To purchase timeframe

- Location of the assets

- Price range and you will down-payment amount

- Preferred bank

- Household earnings

- Credit history

- Personal Coverage Amount

On the back-stop, loan providers indeed shell out LendingTree to own its offers provided so you can people. The lending company will pay LendingTree a charge, seats on their loan standards, and you may LendingTree uses that data to help you match pages with around four potential finance.

Advantages and disadvantages of using LendingTree for your home Financing

Among the advantages of playing with LendingTree is the fact it allows one save time and you can dilemma. Instead of completing four independent models or and also make four independent phone calls, you’ll be able to obtain the ball rolling toward numerous financing quotes with just just one submission.

The most significant disadvantage away from LendingTree is that not all the lenders be involved in the business. It means however buy the reduced-prices mortgage available to you from the marketplaces, there might in fact end up being a more affordable, non-LendingTree offer available to you that’s a much better fit.

Other large disadvantage is that LendingTree deal leads and you may analysis. It means after you have registered your data, they sell it so you’re able to loan providers who would like to compete for your providers. So it commonly contributes to a barrage of letters, phone calls, and sale emails away from lenders looking to sell you on the mortgage options.

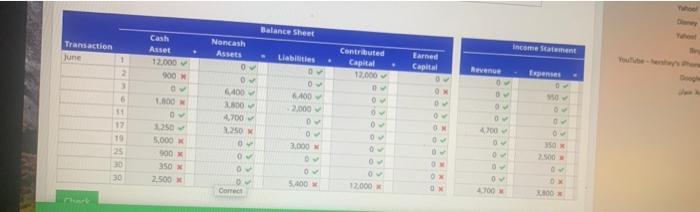

LendingTree’s has the benefit of are available on their own, via emails of for each and every matched bank. This will allow it to be difficult to evaluate financing options, since the for each includes various other rates, things, APRs, terms, or any other facts. You likely you want a spreadsheet or calculator helpful to help you sort out the leader.

Approaches for Achievements

Should you choose opt to have fun with LendingTree to guage your mortgage or any other financing choice, upcoming think carrying out good spreadsheet or any other file effectively contrast their has the benefit of. Do articles www.paydayloansconnecticut.com/trumbull-center for interest, ount, financing term, area will set you back, or other facts. Make certain that you will be contrasting oranges in order to apples when considering each financing provide you with discover.

Its also wise to have a good idea off what you are searching to have when filling out your LendingTree application. Understanding the price range you are looking to buy during the, the location in which you will end up to order, plus credit rating and you will family income normally all the help you advance, so much more well-correct financing choices for your property purchase.

Eventually, dont setup your own LendingTree app if you do not are set (otherwise most close to) buying your domestic. Predicated on LendingTree in itself, you are unable to cancel your loan demand rather than getting in touch with each paired bank individually. You’ll also must installed an alternate financing request if you need to enhance or change the data your joined towards form. Wishing if you don’t are nearly prepared to get may help clean out content software, and early phone calls and characters out-of eager lenders.