What is actually a mortgage conditional approval? Does it indicate I will be approved for property loan? Or perhaps is indeed there a go I am going to be turned down at eleventh hour?

These are several of the most faq’s i discovered from your clients, on the subject of financial underwriting. Therefore we decided to address every one of them in one single article. Let us begin by discussing just what a good conditional recognition method for you, because the a borrower.

Precisely what does a home loan Conditional Approval Imply?

During the a credit perspective, an excellent conditional approval occurs when the loan underwriter is usually fulfilled for the application for the loan file, but there are a minumum of one problems that need to solved until the contract can intimate. During the mortgage language, these left facts or products are commonly referred to as criteria. And that the phrase conditional approval.

Did you realize: The newest underwriter ‘s the person that recommendations the borrowed funds file, and all of data consisted of in it, in order that they match this new lender’s recommendations along with any supplementary guidelines (from FHA, Freddie Mac, etcetera.). Find out about underwriting.

You could consider the home loan underwriter as the a type of documentation investigator whoever work it is to make sure things are managed. And it’s really a fairly outlined jobs, because there are a lot of files and you may documents of the the typical financial.

When your underwriter identifies that financing is pleasing to the eye for the majority areas – but you’ll find a few things that need to be fixed – its called an excellent conditional financial acceptance.

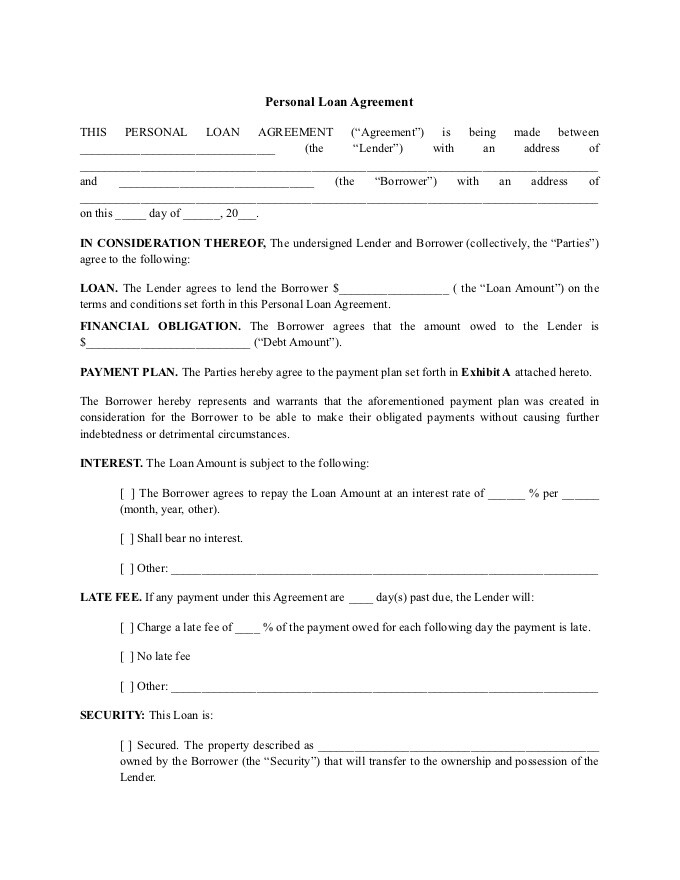

To get it on the a broader perspective, let’s look at the simple actions one to result throughout the a normal mortgage recognition process. Although it is really not in fact found on the visual less than, an excellent conditional approval do take place in between tips 5 and you will 6. It can happens considering the underwriting procedure and you may until the final recognition.

We have found a bona fide-Industry Analogy

John and you will Jane have taken out home financing, and you can they will have offered most of the data files its financial has questioned up until now. The financing document then progresses towards underwriter, who feedback it for completeness and you will reliability. He and checks the brand new document to make certain the mortgage criteria had been satisfied.

The fresh underwriter decides your individuals are eligible for financing, and therefore the latest file consists of that which you necessary to meet criteria. Which have you to definitely exception. An enormous deposit is made to your borrowers’ bank account within the final couple weeks, while the underwriter struggles to dictate in which that cash emerged regarding.

Therefore, he situations what amounts to a conditional recognition with the financial mortgage. He relates they back to the borrowed funds manager or chip and you will claims the guy needs to understand source of the brand new recent put. This might be an ailment so you’re able to last recognition. So it items have to be resolved through to the underwriter can be claim that the loan is actually clear to shut.

Now the ball has returned throughout the borrowers’ courtroom. They’ve essentially become offered a job to-do. They want to now render a page of explanation which can go to the loan file.

If John and you will Jane can completely document the cause of the advance payment, plus it ends up the money originated in a prescription origin, then the loan are acknowledged. The past standards was eliminated, and also the few are now able to proceed to intimate towards home.

Preferred Conditions’ Identified by Underwriters

The truth over is certainly one instance of a mortgage conditional acceptance. For the reason that reasonable analogy, the new borrowers needed to explain and you may document a massive deposit to the their savings account.

- A copy of your own homeowners insurance policy

- Confirmation off borrower’s current a career and you will/or money

- Proof financial insurance rates

- Letter of factor out-of borrower to have a current withdrawal

- Most other destroyed or incomplete documents you’ll need for financing financial support

This is simply a limited a number of well-known mortgage problems that would need to end up being fixed before last approval. You could encounter most other demands via your underwriting techniques. Or you could cruise from the process without a lot more needs anyway. The procedure varies from you to borrower to the next.

Tend to My personal Mortgage However Read?

There are many different degree regarding approval in the financial lending process. But there’s singular latest acceptance, that’s when the financing is largely financed (within otherwise ahead of closing). It is essential to understand that things can go completely wrong at any phase associated with procedure, up toward latest closure.

That isn’t designed to alarm your, however, so you can plan the method – and also to know how it all really works.

Homebuyers and you may mortgage consumers will believe he is domestic totally free when they discover a pre-approval out of a loan provider. But that is untrue. A good pre-recognition only setting there is certainly a probabilities you’re approved to your financial, due to the fact underwriter offers a beneficial thumbs-up.

Being pre-acknowledged features its own masters. It can help you narrow your own construction look and might generate manufacturers more likely to simply accept your promote. But it’s not a make sure the deal goes due to.

There are numerous products and issues that might occur ranging from pre-approval and you may funding. The latest conditional home loan approval is just one illustration of an intermediate action which may occur.

As a debtor, a good thing you can certainly do in case there are a good conditional acceptance would be to resolve most of the criteria as fast as possible.

Correspond with your loan manager in this phase (it’s usually an important point away from get in touch with). When your underwriter makes reference to a condition which need to be resolved, the mortgage is essentially toward hold up to you to definitely concern is resolved. Getting hands-on at this time can help prevent unwanted delays and you will secure the closing into the plan.

The length of time to close After a great Conditional Recognition?

Thus, how much time does it decide to try personal to your an interest rate, once receiving a great conditional acceptance regarding the underwriter? Do you actually be in a position to romantic punctually? Otherwise commonly this new conditions decrease your closing?

- New the quantity and you may complexity of one’s known payday loans Union Grove condition’

- The time it will require on how best to manage the new situation

Sometimes, these types of situations will likely be resolved in this twenty four hours or several. Use the letter regarding reason circumstance said prior to, for example. You can develop a letter to spell it out a bank withdrawal or put an equivalent date you will get this new demand. The fresh underwriter could after that obvious you to topic and proceed.

In other cases, you may need to do a little more legwork to respond to an issue. Perhaps you have so you’re able to gather particular files or generate a couple phone calls. This can create time for you to the brand new underwriting procedure, which might push their closure right back a short time.

While the a debtor, the best thing you certainly can do was stay in touch with the loan administrator and you will deal with one requests in a timely fashion. Others may be out of the hands.