***Active instantaneously, the newest Athens-Clarke County Homes and you can Neighborhood Creativity (HCD) company possess suspended the new receipt of any brand new home software not as much as your house Resource Partnerships Program (HOME).

HCD won’t deal with Domestic software into the a first come, very first supported, rolling period foundation. HCD continues to believe latest or pending Home software having honor investment by the end of your fiscal season, .

The changes and standing on Family program will be presented to help you interested individuals through to the the newest competitive Home years opens up in . The latest You.S. Company out-of Property and you can Urban Development’s (HUD’s) Household finance is actually provided annually, and you will programs to own regional Domestic investment would-be acknowledged to have forecast offered Home FY24 investment (fund obtainable in ).

HCD will use ten% of annual Domestic allocation to own management of the system. (more…)

To exactly who they complaint #********. I have paid with Up-date **** it appears there’s specific misconception and you will misinterpretation on the each other accounts. The business have favorably caused me personally. I that have mark my personal complaint and enjoy greatly together with your assist in this problem.

You want to talk to you in order to disperse send with resolving this issue. Please get in touch with the Customer Advocacy Group in the **************, Monday- Monday, 7am-6pm MST.

Delight contact our Financial class at the first comfort by the dialing **************, Tuesday because of Friday, 6am-8pm MST and you may Friday thanks to Week-end, 7am-6pm MST.

We wish to thank you for providing us with their views and allowing you be aware that all of our provider don’t see your own expectations. We will use this views to help you increase all of our full customers experience. I enjoy you taking the time to take this to our attract.

Our info indicate that the newest overpayments written into the totaling $ was indeed reimbursed returning to their 3rd-party checking account to your ount off $a hundred was released towards third-people savings account into the . (more…)

Foreclosure is an appropriate process that allows a lender to offer property to settle a great borrower’s past-due home loan.

While having difficulty paying their financial, score let rapidly. Their home loan servicer, a beneficial You Company out-of Construction and you may Metropolitan Creativity (HUD)-recognized construction therapist, and an experienced attorneys may be in a position to give alternatives to help you save your family. However, you should require assist quickly, because possibility of preserving your house drop because you slip subsequent about.

Inside basic thirty six weeks after destroyed a repayment, you can aquire a visit from your servicer. (more…)

For individuals who individual a business, there are many instances where you need an extra increase of cash. You ent, vast majority upon index, if not buy even more a residential property to expand your business. When you are just starting, you’ll need a loan to greatly help get organization upwards and you will running. No matter why you you desire currency to suit your needs, you may find oneself wanting to know in the event that an unsecured loan are a beneficial suitable alternative.

Regrettably, the solution is not clear cut and you may mainly depends on your financial predicament, your online business needs, and your personal preferences. Let’s have a look at a few of the positives and negatives in the having fun with an unsecured loan to have providers motives.

• Might possibly be better to qualify. If you’re looking for a financial loan to start a business, you have got a hard time getting recognized for a business financing. It could be difficult, if not impossible, to track down a corporate mortgage for a start-abreast of a concept or business strategy by yourself. Inside variety of situation, when you have an excellent individual credit rating, an unsecured loan might possibly be an easy way to have the resource you should get a unique team up and running.

• Less recognition. Signature loans essentially require reduced paperwork and you can documentation than just a business financing, that will result in a more quickly approval big date. (more…)

He told you others several facts is actually discussed regarding the Colorado https://cashadvanceamerica.net/loans/tribal-loans/ Best Court’s Doody elizabeth ruling you to Pfeiffer quoted inside her oral dispute he said claims there are already regulating and you will organization bonuses in position. Into the regulating front side, Hastings told you the previous view claims if the a lender isnt during the compliance for the structure, they could need certification factors in order to stand operating. The guy told you the business incentives is that loan providers have to comply towards Tx Composition as it often hurt its company when the they don’t really. Ultimately users would not want to do team towards the lender you to doesn’t follow the laws, the guy told you.

Constitutional mandates need not be shoehorned towards preferred-rules concepts whenever those people concepts dispute into Constitution’s basic text, influenced Justice Debra Lehrmann on the bulk thoughts. She are inserted of the Justices Phil Johnson, Eva Guzman, Jeffrey Boyd, John Devine and you can Jeff Brown.

The text of Structure and you may our very own choice into the Doody create not help a holding you to liens securing constitutionally noncompliant home guarantee fund are just voidable, Justice Lehrmann composed. A voidable lien is thought good until afterwards invalidated…” If you find yourself section 50 and you will Doody think of just the contrary: you to definitely noncompliant liens is actually incorrect until generated good. Holding or even manage essentially allow lenders to ignore the Constitution and you may foreclose towards the homesteads regarding unwitting borrowers who do perhaps not comprehend one their property collateral loans break the brand new Constitution. (more…)

For those who have way too much guarantee gathered from inside the your residence and want to transfer you to equity into actual money you need to use, a cash out refinance can make feel for your requirements. Here are some of the secret items you should know.

A cash out refinance occurs when you take out another home loan for much more currency than you owe on your latest financing and receive the difference between bucks. Particularly, in the event your house is worth $3 hundred,one hundred thousand and you owe $200,100, you have $one hundred,one hundred thousand in equity. With cash-out refinancing, you could discover a portion of it security within the cash. For people who planned to remove $forty,000 inside the cash, it count will be put in the primary of your own the fresh mortgage. (more…)

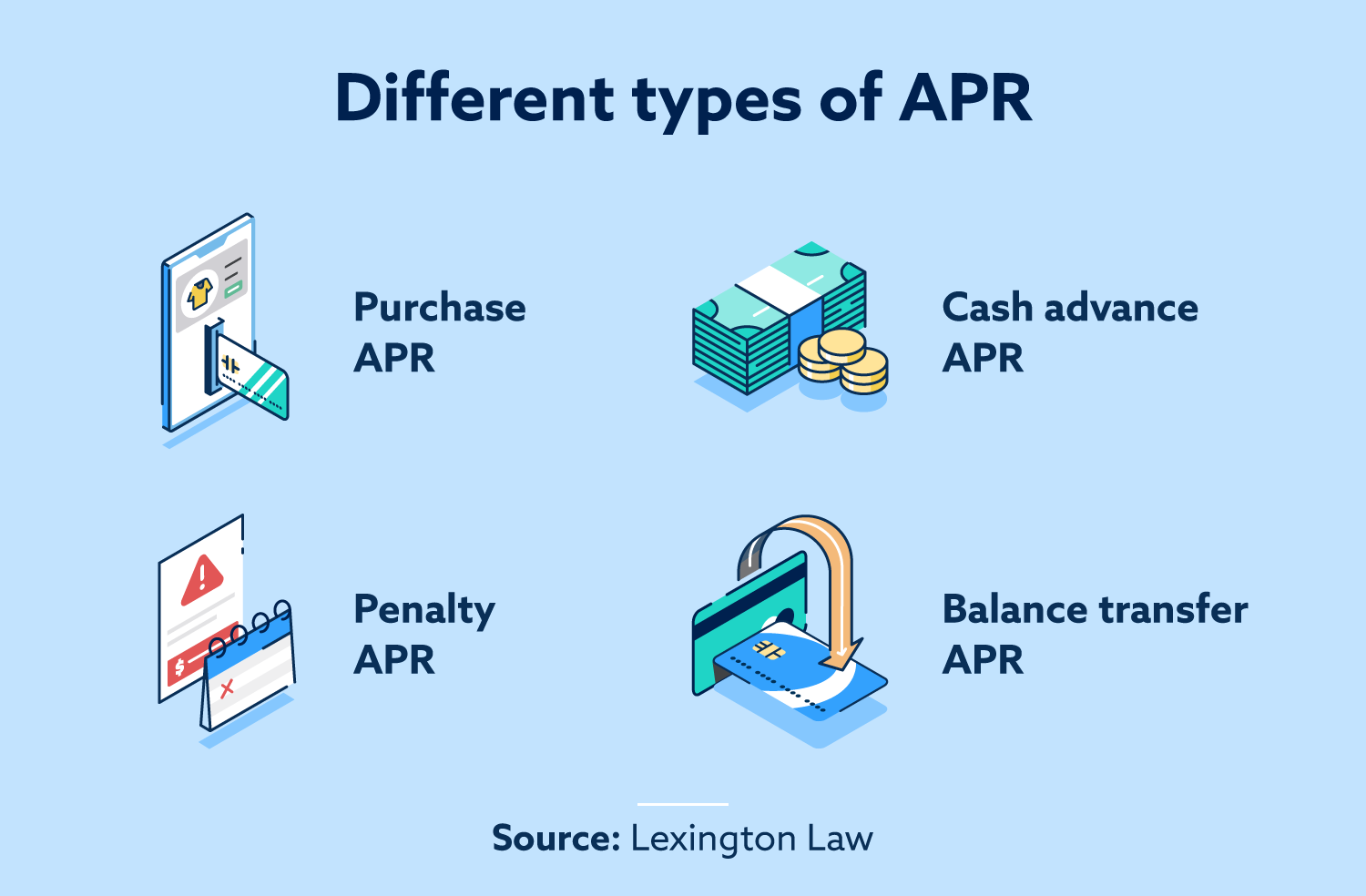

See throughout the chart less than that each and every of them borrowing from the bank products has actually an alternative affect their get. Percentage history and you may credit utilization feel the very feeling, while the different kinds of borrowing from the bank both you and feel the count out-of concerns in your report feel the minimum.

Knowing the different facets that go into your 650 credit rating can certainly help you’re taking the best strategy into the enhancing your borrowing from the bank. However,, can you imagine you do not have for you personally to generate large borrowing from the bank alter? So what can you would expect that have a 650 credit score, whenever you make zero improvements.

One of the first issues i https://cashadvanceamerica.net/loans/emergency-cash-for-single-mothers/ tune in to when speaking with members is Exactly what do We assume with my get? (more…)

Purchasing a property the very first time is going to be a very pleasing time-first-time home buyers within the Michigan depict an important milestone inside the the fresh changeover from renting so you can homeownership.

As with any trip, picking out the primary house to you is sold with its unique highs and lows, full of fury, triumph, excitement, and you will doubt.

No matter whether you might be ready to initiate domestic bing search or you might be merely exploring the chances of to shop for a home, facts the choices because the an enthusiastic MI very first time family customer can be make a world of differences when you take away an excellent Michigan earliest home loan.

With respect to to acquire a house, affordability is more tricky than just finding out how much Michigan first time homebuyers can also be acquire.

First-time homebuyers into the Michigan will also have when planning on taking into consideration a lot more affordability factors, like the settlement costs of shopping for a property, month-to-month finances, and debt-to-earnings proportion.

Go to all less than websites to use Michigan first-time domestic visitors calculators to research activities like place, house income, advance payment, and you will month-to-month loans. (more…)

The low-rates financial motorboat has actually sailed. Predicated on Freddie Mac computer, the common interest to the a thirty-seasons repaired-price home loan is becoming 6.7%, more than twice as much step three.01% rates out of this time last year. That has carry out-become property buyers and you may sellers stressed. And you will homeowners having variable-price mortgages aren’t happy sometimes. Very for it week’s Large Q, Barron’s Advisor asked economic advisers what they’re advising customers at this time on the mortgage loans and you may home buying.

Sarah Ponczek, monetary mentor, UBS Personal Wealth Management: Timing the actual estate marketplace is as difficult, if not more very, than simply time the stock market, because the housing market is far more illiquid. And so the most readily useful time for you to purchase a home is when you getting able and when you then become as if you really can afford they. First thing you have to do is to try to just take a great a close look about mirror and you may it is ask yourself, Just how much can i manage to invest monthly into the a home? You must factor in your own fees and your insurance and your own fix repayments, anything that you are going to qualify due to the fact a property bills. A great principle is that you should not become spending more twenty eight% to help you 30% of the pretax income towards property will set you back. (more…)

If you find yourself a first-go out homebuyer within the Fl , you are in chance! There are a number of advanced federal and you can local software to help you make buying your very first home smoother than ever before. Whether or not you select a traditional loan or other variety of financial, all of our guide to first time homebuyer funds during the Florida will be here so you’re able to understand the options.

The new Government Construction Government (FHA) Loan try an application that provide to have lenders to individuals with little to no credit score or even to first time homebuyers.

Brand new FHA Loan allows a high credit history and lower loan-to-worth. not, it comes down with an increase of paperwork than just extremely, there was income standards making it performs.

Brand new Va Loan program ‘s the most useful selection for pros, energetic obligations military, as well as their parents wanting home financing. Experts, in addition to their group, be eligible for Va money to have causes eg employment standing, disability, or even the loss of a girlfriend.

Fl also provides multiple apps, although one that have a tendency to provides the most attention is the Homeownership Possibility Loan (HOL) system.

Official First-Go out Homebuyer (C/FTHB) mortgage Program: If you’re a first-time homebuyer, you might be permitted discover as much as $7,five-hundred in pre-approval loan financing.

Very first time Homebuyer (FTHB) program: If you are a first-go out homebuyer, you’re entitled to receive as much as $seven,five hundred within the pre-acceptance loan funds. Fl Veterans Very first time Homebuyer (FTTHB) program: You are qualified to receive as much as $seven,500 in the pre-recognition financing money to suit your earliest-big date domestic buy. (more…)